Tidepoint Construction Group for Dummies

Wiki Article

Tidepoint Construction Group Can Be Fun For Anyone

There are a lot of points that can take advantage of a fresh layer, from cabinets to stairwells to an accent wallresearch which colors work best where. Light colors make tiny spaces look bigger, so brighten up washrooms and also smaller sized locations with those. Make sure to seek advice from with an expert on which kind of paint to utilize before buying, as some are less at risk to mold as well as mildew if made use of in a bathroom. http://connect.releasewire.com/profile/680086/links.

Invest in ADA-compliant accessories like bathroom tissue owners and towel bars that not just include in the appearance of your home however the safety and security of it too. In addition, points like motion-activated outdoor lights are not only energy-efficient yet can discourage intruders from entering your house. While numerous presume renovation is only helpful from a cosmetic point of view, there are a handful of various other benefits that occur from upkeep, remodels as well as constant fixings specifically why there are many programs dedicated to investing and lending cash towards it.

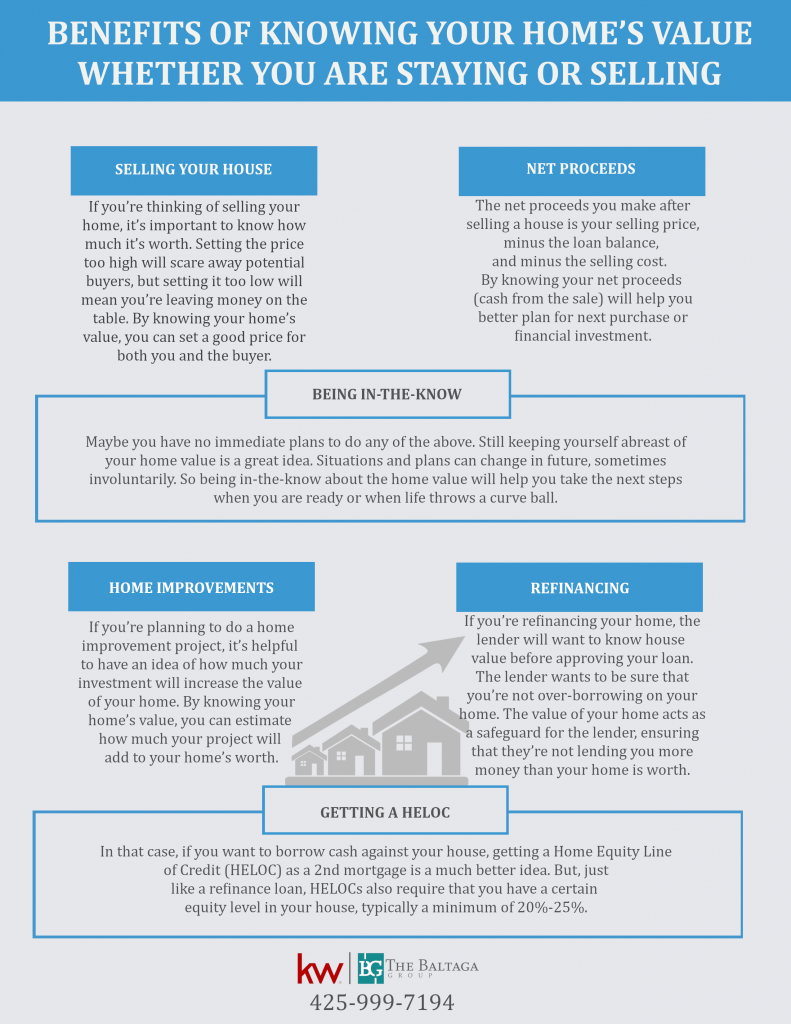

Despite the fact that you may be forking up cash at initially, purchasing top notch materials upfront will certainly enable for much less pricey and undesirable repair work in the process. Similar to the above point, purchasing upgrades can enhance the resale value of your house should you plan to sell in the future.

A fresh layer of paint or a recently crafted residence health club can foster a minimalist home as well as mind.

The Of Tidepoint Construction Group

Are residence repair work or upgrades tax obligation deductible? If so, what house enhancements are tax deductible? In various other words, residence enhancement tax obligation credit ratings are a dollar-for-dollar decrease of taxes as well as reductions are reduced by how much money you make per year.

It eventually boils down to what kind of remodel you're finishing and whether it's identified as a fixing or a renovation. is any adjustment that recovers a residence to its original state and/or worth, according to the IRS. Home repair services are not tax obligation deductible, except in the case of office and rental properties that you have even more ahead on that later in this guide.

, a new septic system or built-in home appliances. Residence renovations can be tax deductions, but some are only insurance deductible in the year the home is offered.

The smart Trick of Tidepoint Construction Group That Nobody is Discussing

If you're not sure whether a repair service or renovation is tax obligation deductible, speak to a neighborhood tax obligation accountant that can answer your questions concerning declaring. Please note house renovation financings aren't tax deductible because you can not deduct interest from them. If this puts on you, stop checking out here. Instead, emphasis on where you can get the finest return when selling your home with these pointers.

The solar credit history will certainly remain till 2019, as well as then it will be reduced each year via 2021." Putting solar power systems on new or present residences can still result in a 30% credit scores of the overall price of installment. This credit is not restricted to your key house as well as is also offered for recently built houses.

Tax Obligation Deduction Exact same Year Tax-deductible residence enhancements connected to clinical care are frequently difficult to find by. If you plan on aging in place, these reductions may put on you in full. You can consist of costs for medical tools set up in your house if its main objective is to supply look after you, your partner or a reliant.

Fixings made directly to your workplace Improvements made straight to your office area Fixes made to other why not try here parts of the house (partially deductible) Some enhancements made to various other parts of the residence (partly deductible) Repair work that straight impact your organization space can be deducted in full (e. g., mending a damaged window in your office).

Some Known Details About Tidepoint Construction Group

If your workplace occupies 20% of your home, 20% of the improvement expense is tax-deductible. Kitchen remodeling company near me.

8% Rating serious resale worth as well as some wonderful R&R time by adding a timber deck to your yard. Simply make certain to add barriers, pressure-treat the timber, and seal it to shield it from the components.

If it's too stylish or as well tailor-made, it will likely estrange some buyers when you're prepared to market.

Report this wiki page